Under-performance of Screening Strategies

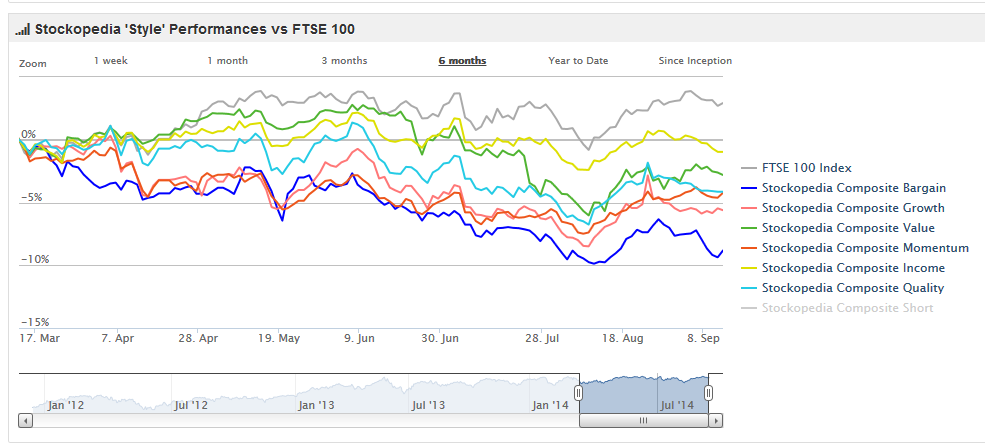

The last six months has been hard going for rules based investors. Just take a look at Stockopedia's "style" performances against the FTSE 100 index. These are composite strategies based on subsets of Stockopedia's 66 guru screens:

While the FTSE 100 increased by 2.9 percent in the last 6 months, all investment styles lost ground. Of the individual screens making up each up these composites, only nine out of 60 (long screens) beat the FTSE 100. The "Screen of screens" is a composite strategy flagging up stocks appearing in multiple screens. It is down 5.2 per cent over the last six months, about the same as the Mechanical Bull portfolio. As I've discussed in a previous post, these composite indices have tended to track the FTSE 250, which has pulled back about 5 per cent since it peaked at the end of February.

My take is that the FTSE 100 is increasingly acting as a refuge for when financial markets enter a 'risk off' phase. During these times capital normally flows out of equities and into bonds. However, with the returns from gilts and corporate bonds so pitiful, money is instead flowing into defensive large caps paying consistent dividends. These are essentially stocks with bond-like characteristics.

It is worth noting from the above chart that income strategies have performed best over the last six months. Tobacco, oil, pharmaceuticals and utilities have all done rather well. Income based strategies would have done even better if it weren't for the recent dire performance of Morrisons and Tesco, which have been worst performing FTSE 100 stocks over the past six months.

This idea of the FTSE 100's emerging role as a safe haven is supported by the observation that it seems to be reacting less strongly to geopolitical events. Rapidly deteriorating relations between Russia and West and even the prospect of Scotland leaving the UK have barely made a dent. The FTSE 100 has just been moving sideways in a fairly narrow band while the FTSE 250 has been drifting down.

Some commentators seem to think that the market is due for a 10% pull-back. However, I think it will take something pretty major to shake investor confidence. A vote for Scottish independence would do it, although I think this is unlikely.

So basically, the last six months have been "risk off" with a net flow of capital from small and mid caps to large caps. Further, this under-performance of most screening strategies has to be seen in this context and not as fundamental failure of these approaches. These strategies should go on and outperform when the market goes risk-on again.

For me, the overriding question is, where else are investors supposed to put their money? I recently got a letter from my bank telling me that they had made the "difficult decision" to reduce the rate on my savings account from 1.3% to 0.9%. I have been keeping a chunk of my savings as a war chest for the next pullback. But this means I am now losing even more money in real terms and what if my new thesis is right and a stockmarket pullback doesn't come? Putting money into defensive dividend paying stocks rather than bonds during this "risk off" phase would seem to be a sensible strategy and perhaps, the market has already worked this out.

Mechanical Investing and "Fraudulent Stocks"

I will start off here with a disclaimer that I am not asserting that any of the stocks mentioned in this section are necessarily fraudulent stocks. I do not have the relevant expertise to make these judgements. However, other commentators have made these kind of assertions and so I am referring to the risk that these stocks could be fraudulent.

Naibu Global International (NBU) is a Chinese AIM-listed shoe manufacturer, which released its "unaudited" interim results on Friday. For seasoned investors, the words "Chinese" and "AIM-listed" are virtually synonymous with fraud. Naibu currently has a PE ratio of less than 1, so if it isn't a fraud, then it is the bargain of the century.

The company announced the suspension of dividend payments, supposedly to fund construction of a new factory. However, as the dividend was the one thing giving Naibu some semblance of credibility, investor confidence evaporated and the dropped over 40% in one day. Paul Scott gives a fuller commentary on his Small Cap Report. There is an interesting clip from the UK Investor show back in April where Lucien Miers tells of meeting a Chinese student who not only hailed from the same city where Naibu is based, but also had family connections within the shoe industry. The student had never heard of Naibu!

I don't have a position on Naibu. However, I am very interested in it because my rules based system came very close to flagging it up for purchase earlier in the year. Indeed, even now, it pops up in an incredible 13 Stockopedia guru screens. Perhaps this partly explains why Stockopedia's Screen of screens has been underperforming of late.

In any case, this highlights one of the inherent risks of mechanical based investing systems. It is not easy to design a system that filters out companies producing fraudulent accounts. There are some well known "red flags" that may be indicative of aggressive accounting practices. These include growing reported earnings but negative operating cash flow and the Beneish M-Score which aims to measure risk of earnings manipulation. However, the later is a probability measure that can produce false positives. One of my most profitable investments over the last 18 months was Kentz, which I almost bailed out of at a loss because of a just such a red flag. Of course, an "unaudited" set of accounts could be a complete work of fiction in which case the any red flags would be qualitative in nature and impossible to incorporate into a mechanical based strategy.

Early last year I bought Globo as it had being flagged up on a large number of Stockopedia screens. Globo is not a China-based stock, but it is on AIM and anyone following Globo will be aware that it is another controversial stock. It was also subject to a bear raid towards the end of last year. Fortunately, I timed my exit pretty well and I managed to secure healthy 46% profit. However, this was almost certainly down to luck rather than any skill on my part.

The problem is that "strategic ignorance" is a cornerstone of my investment philosophy. Joel Greenblatt is his book the "Little Book that Beats the Market" urges investors to "trust the quant" and select stocks at random that meet the investment criteria. He argues that the ugliest looking stocks will often deliver the best returns and that investors trying to apply their own judgement will just sucked into systematically making the wrong decisions.

However, I suspect that Joel Greenblatt developed these ideas well before dodgy Chinese stocks started popping up in Western stockmarkets. Stockopedia's screen based on Greenblatt's Magic Formula has performed poorly over the past 2 to 3 years. It has performed especially badly over the last six months, falling over 13%. This is hardly surprising given it has been flagging up the likes of Quindell (another highly controversial stock) which has dropped around 70% over the past 6 months.

The point here is that a purely mechanical based investment approach involves inherent risk. If you do not undertake due diligence, you risk buying into a company that may be fraudulent. I don't think it is possible to eliminate this risk, but for my part, I will be tweaking my investment rules again to filter out any Chinese based Aim stocks. Fortunately, the Mechanical Bull portfolio has so far managed to avoid any complete disasters. Hopefully I can minimize them in future.